Bene ira rmd calculator

How is my RMD calculated. As a beneficiary you may be required by the IRS to take.

A Guide To Required Minimum Distributions Rmds

Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and.

. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. This calculator has been updated to reflect the new. The 10-year rule applies regardless of whether the participant dies before on or after the required beginning date RBDthe age at which they had to begin RMDs.

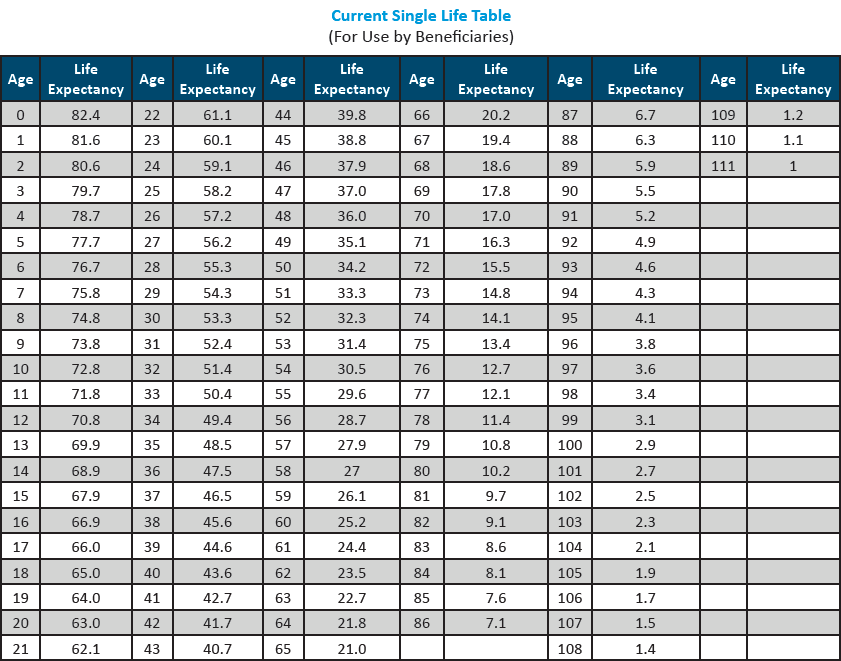

Determine beneficiarys age at year-end following year of owners. The SECURE Act of 2019 changed the age that RMDs must begin. If you want to simply take your.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. But if you want to defer taxes as long as possible there are certain distribution requirements with which you must comply. Determine the required distributions from an inherited IRA.

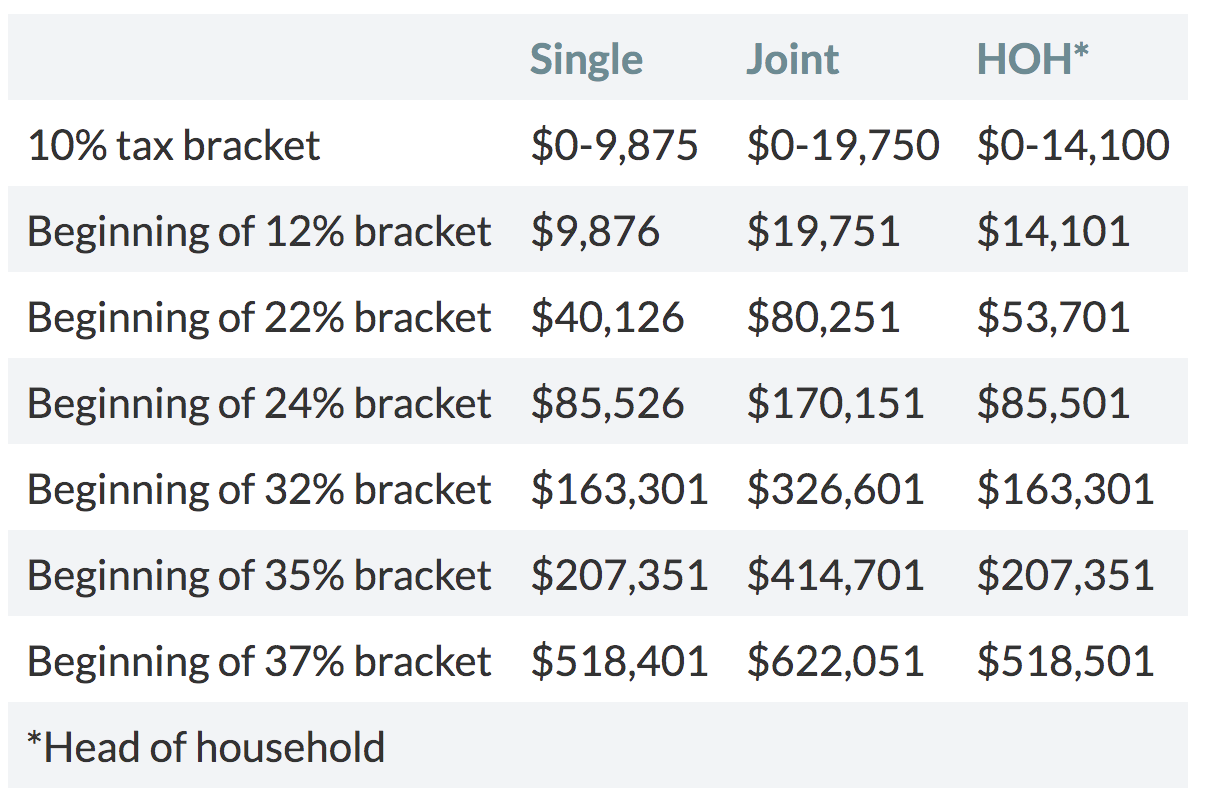

The IRS requires that most owners of IRAs withdraw part of their tax-deferred savings each year starting at age 72 age 70½ if you attained age 70½ before 2020 or after inheriting any IRA. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Distribute using Table I.

Get your own custom-built calculator. Helping clients in Setting Up family estates trusts and foundations Before Retirement. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. If inherited assets have been transferred. Schwab Has 247 Professional Guidance.

Account balance as of December 31 2021. Calculate your earnings and more. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

It Is Easy To Get Started. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so.

The IRS has published new Life Expectancy figures effective 112022. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. If you were born on or after.

Determine your Required Minimum Distribution RMD from a traditional 401k or IRA. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. Beneficiary Date of Birth mmddyyyy.

For IRA distributions see Publication 590-B Distribution from Individual. Ad Financial Advisers For Retirement Planning and How They Help You Plan for Retirement. 401k Save the Max Calculator.

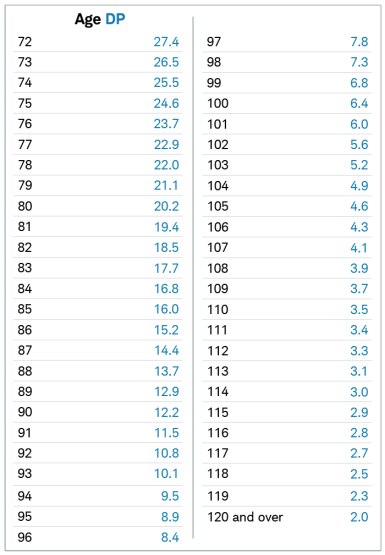

Your life expectancy factor is taken from the IRS. Therefore if the distribution is from a qualified plan the beneficiary should contact the plan administrator. We offer bulk pricing on orders over 10 calculators.

Use this calculator to determine your Required Minimum Distributions. Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. This calculator has been updated for the.

401k and IRA Required Minimum Distribution Calculator. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Calculate your earnings and more.

Ad Understand Your Options - See When And How To Rollover Your 401k.

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

Where Are Those New Rmd Tables For 2022

Irs Wants To Change The Inherited Ira Distribution Rules

Rmd Tables For Iras

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator

2

Required Minimum Distribution Rules Sensible Money

Required Minimum Distribution Calculator

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Required Minimum Distributions Rules Heintzelman Accounting Services

How To Calculate Rmds Forbes Advisor

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Required Minimum Distributions For Retirement Morgan Stanley

Required Minimum Distributions What You Should Know Retirement Plan Services